Disability Insurance

- Long-term disability insurance can provide financial support if you are unable to work due to a serious illness or injury.

- This type of insurance can help cover your living expenses, such as your mortgage or rent, groceries, and medical bills.

- It can also provide financial security for your family, allowing them to maintain their standard of living.

- Without long-term disability insurance, you may have to rely on savings, investments, or other sources of income to cover your expenses, which can be difficult or impossible for many people.

- Additionally, long-term disability insurance can give you peace of mind, knowing that you have a safety net in case of a disabling event.

WHAT IS YOUR BIGGEST ASSET?

Check out this great video on the importance of disability insurance.

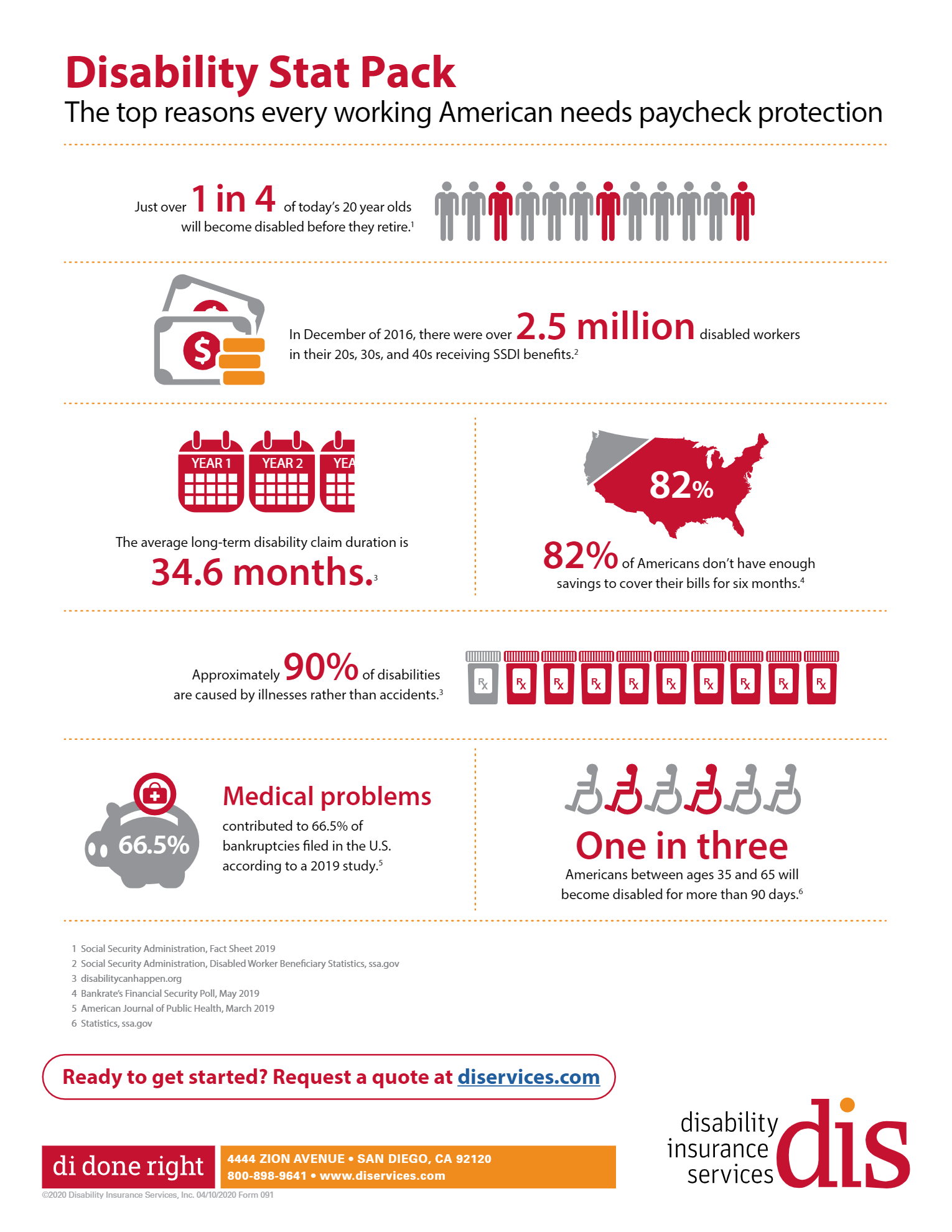

Why you should pay for disability insurance

The likelihood of becoming disabled.